AI-Driven HubSpot Solutions for Fintech & Financial Services

We design, implement and optimize HubSpot for financial institutions and embedding AI across onboarding, compliance, and customer operations to power intelligent growth.

Helping Financial Teams Win with AI + HubSpot

As a HubSpot Elite Partner, we tailor HubSpot for financial services, blending automation and AI to drive speed, compliance, and smarter growth.

Banking

Traditional banking teams struggle to manage customer relationships across disconnected systems. We configure HubSpot’s AI to unify data, automate engagement, and identify cross-sell opportunities, helping teams deepen relationships at scale.

Fintech

Fintech teams struggle to convert signups into long-term customers. We enable HubSpot’s AI to automate onboarding, personalize engagement, and detect churn early, turning every activation into lasting retention.

Investment Management

Advisors manage vast portfolios but lack unified insights across relationships. We configure HubSpot’s AI to centralize investor data, automate reports and disclosures, and surface engagement cues that strengthen trust and retention.

Lending

Lenders manage complex, compliance-heavy loan cycles that slow growth. We use HubSpot’s AI to automate KYC, streamline approvals, and track borrower engagement, giving teams full visibility from application to repayment.

Insurance

Insurers struggle with slow renewals and disconnected claims processes. We use HubSpot’s AI to automate policy workflows, predict lapses, and personalize renewal outreach, helping agents retain more customers with less manual effort.

NBFCs

NBFCs often struggle with fragmented sales and collection data. We configure HubSpot’s AI to unify leads, disbursals, and repayments to automate reminders, track performance, and giving teams real-time visibility into every borrower journey.

How We Make HubSpot CRM Work for Finance

Financial services run on data and trust. HubSpot delivers the system & we add AI intelligence that connects teams, automates compliance, and adapts to the pace of fintech and BFSI.

Compliance-Ready CRM for Regulated Environments

Stay audit-ready while keeping customer data fully secure.

Every customer interaction, loan update, or policy change is logged, traceable, and auditable inside HubSpot. Role-based access controls, field-level encryption, and activity histories ensure full transparency across teams while meeting financial compliance standards.

Automated Onboarding and KYC Workflows

Simplify KYC and activation without compromising oversight.

Eliminate repetitive manual checks with automated KYC and onboarding workflows. Connect verification tools, trigger document requests, and move approved leads into activation stages without losing compliance visibility.

.jpg)

Dashboards for Growth and Risk Insights

See every approval, renewal, and risk trend in one place.

Gain real-time visibility into approvals, renewals, churn, and retention. Predictive scoring highlights at-risk customers, while AI-assisted dashboards help leadership identify conversion bottlenecks and optimize loan or policy pipelines.

.jpg)

Faster Go-To-Market with Unified Marketing, Sales, and Service

Launch new products faster with connected GTM teams.

Align marketing, sales, and service on one CRM. Coordinate campaigns, onboarding journeys, and support workflows in HubSpot to reduce dependencies and speed up launches across financial products and services.

.jpg)

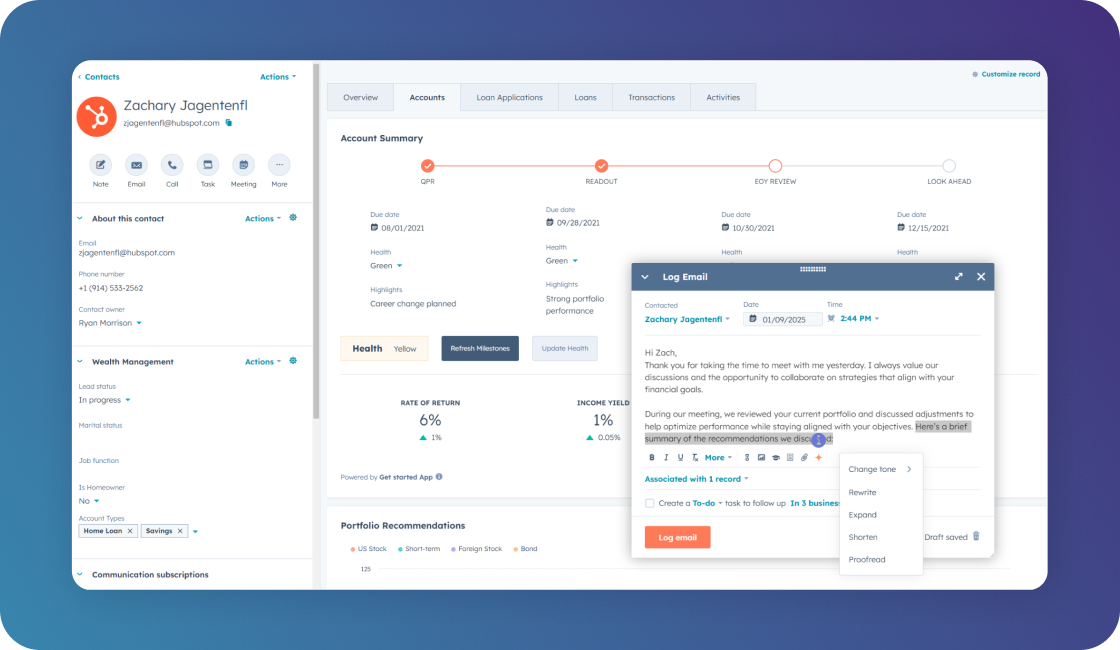

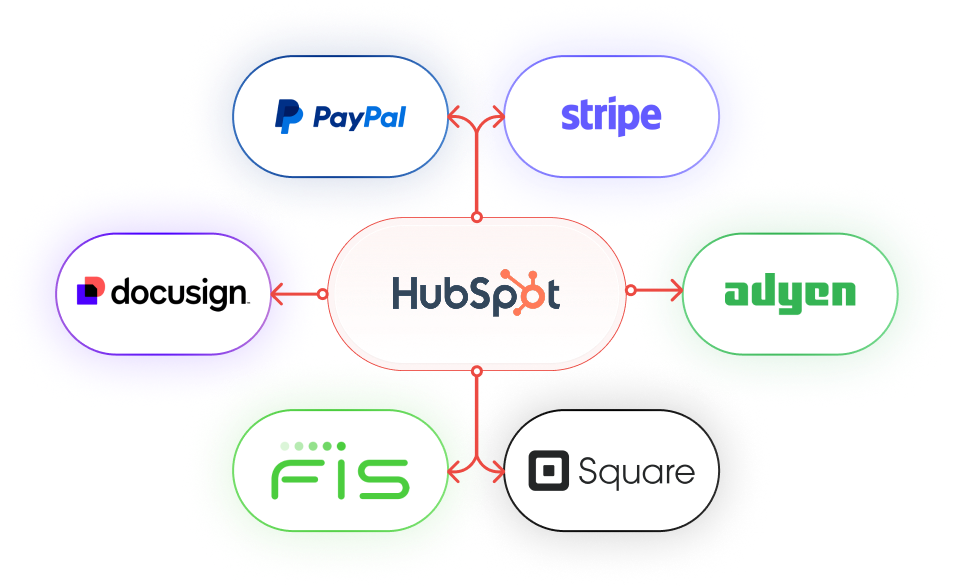

Scalable Integrations for the Finance Stack

Bring your entire financial tech ecosystem into HubSpot.

Connect HubSpot with banking cores, payment gateways, and wealth management systems. Sync real-time payment statuses, policy renewals, loan approvals, or investment activities to keep customer data current and actionable.

Secure Reporting and Audit-Ready Analytics

Get clarity for growth teams and confidence for compliance.

Build dashboards that satisfy both growth teams and compliance officers. Every report, record, and transaction history stays traceable, ensuring clean audits and informed decision-making at every level.

.jpg)

Helping Different Financial Teams Win with HubSpot

Banking & Lending

Loan processing is slowed down by manual checks and fragmented systems. With HubSpot configured for banking, teams can -

- Capture loan applications directly in HubSpot

- Automate KYC & document verification workflows

- Track applications across every stage: Applied → Approved → Disbursed

- Personalize borrower engagement through email, SMS and WhatsApp

Insurance

Policyholder journeys need speed and compliance. HubSpot helps insurers -

- Automate onboarding and renewal reminders

- Manage claims using Service Hub ticketing

- Run cross-sell/upsell campaigns for new policies

- Give advisors a unified client view in HubSpot

Wealth & Investment Management

Advisors need personalization at scale. HubSpot enables:

- Segment investors by lifecycle, geography or portfolio

- Automate disclosures and compliance emails

- Deliver personalized portfolio updates with HubSpot campaigns

- Track advisor notes, calls and meetings in one place

Payments & Fintech SaaS

Recurring revenue businesses can’t afford leaks. HubSpot powers:

- Integrations with Stripe, Razorpay and Plaid

- Automated onboarding: signup → KYC → activation

- Dashboards for MRR, churn and funnel velocity

- Custom objects for wallets, accounts and transactions

NeoBanks

Digital-first banks grow on speed and customer experience. HubSpot supports:

- End-to-end digital account opening workflows

- Retention campaigns across email, SMS and WhatsApp

- Customer health scoring to predict churn

- Mobile app integrations with HubSpot APIs

Microfinance & NBFCs

Emerging finance models need automation without complexity. HubSpot delivers:

- Disbursement and repayment reminder workflows

- Centralized borrower and guarantor records

- Compliance-ready reports in minutes

- Team dashboards for visibility and alignment

How We Make HubSpot CRM Work for Finance

Financial services are complex, compliance-heavy, and customer expectations are rising. HubSpot gives you the platform and we make it work for the realities of fintech and BFSI.

Stay audit-ready while keeping customer data fully secure.

Every customer interaction, loan update, or policy change is logged, traceable, and auditable inside HubSpot. Role-based access controls, field-level encryption, and activity histories ensure full transparency across teams while meeting financial compliance standards.

Simplify KYC and activation without compromising oversight.

Eliminate repetitive manual checks with automated KYC and onboarding workflows. Connect verification tools, trigger document requests, and move approved leads into activation stages without losing compliance visibility.See every approval, renewal, and risk trend in one place.

Gain real-time visibility into approvals, renewals, churn, and retention. Predictive scoring highlights at-risk customers, while AI-assisted dashboards help leadership identify conversion bottlenecks and optimize loan or policy pipelines.Launch new products faster with connected GTM teams.

Align marketing, sales, and service on one CRM. Coordinate campaigns, onboarding journeys, and support workflows in HubSpot to reduce dependencies and speed up launches across financial products and services.Bring your entire financial tech ecosystem into HubSpot.

Connect HubSpot with banking cores, payment gateways, and wealth management systems. Sync real-time payment statuses, policy renewals, loan approvals, or investment activities to keep customer data current and actionable.Get clarity for growth teams and confidence for compliance.

Build dashboards that satisfy both growth teams and compliance officers. Every report, record, and transaction history stays traceable, ensuring clean audits and informed decision-making at every level.Meet the AI Agents Transforming HubSpot for Financial Services

Prospecting Agent for Fintech Sales

HubSpot’s AI Prospecting Agent helps financial sales teams find and qualify high-intent prospects faster. OneMetric tailors it for BFSI use cases — enriching leads with firmographic and transactional data, automating outreach sequences, and surfacing opportunities that match your ideal borrower or partner profile.

Customer Agent for Banking & Lending Teams

This AI Agent turns every support interaction into a revenue opportunity. It instantly surfaces borrower or policyholder data, drafts compliant responses, and recommends next actions. OneMetric trains it for finance-specific use cases like claims follow-up, EMI reminders, and customer risk alerts.

Content Agent for Financial Marketers

Generate compliant, high-performing content directly inside HubSpot. From policy updates to investor newsletters, the Content Agent helps your team write, personalize, and localize campaigns — while OneMetric ensures every output aligns with BFSI compliance standards and tone.

Workflow Agent for Operations

HubSpot’s Workflow Agent helps automate routine processes and even suggests optimizations. For fintechs, OneMetric configures it to self-adjust onboarding flows, credit approval sequences, or retention journeys based on performance data — helping you scale operations intelligently.

Compliance Agent

Purpose-built by OneMetric, this layer monitors HubSpot activity for audit-readiness. It tracks approvals, documentation timelines, and data access patterns — ensuring every interaction meets KYC, AML, and regulatory standards without slowing teams down.

Insights Agent

Designed for decision-makers, this agent combines CRM, payment, and engagement data to highlight portfolio trends, churn indicators, and growth opportunities. It delivers AI-powered dashboards that turn your HubSpot into a real-time financial intelligence hub.

Here's a quick case study :)

.png?width=640&height=750&name=Armin%20Qashio%20(2).png)

Working with OneMetric was amazing! They brought a positive impact on our sales process and team right from the start. We were looking for a HubSpot instance to bring more visibility and structure to our sales process, and they helped us get there. Nanda, Ashish, and Namit were a delight to work with. They didn’t just build dashboards but also helped us shape the right process and trained our team to run with it. Now when I open HubSpot, I can clearly see what’s moving, what’s stuck, and where to focus.

Armin M.

CEO & Co-founder

Frequently Asked Questions

HubSpot logs every interaction, policy update and transaction in a single CRM. At OneMetric, we configure field-level security, role-based access and audit-ready records so teams can operate confidently within regulatory frameworks.

Yes, we build secure, real-time integrations between HubSpot and systems like Temenos, FIS, Finastra or custom loan origination platforms. This keeps customer data, approvals and repayment updates fully in sync.

We handle end-to-end migration for financial organizations moving from Salesforce FSC, Microsoft Dynamics or Oracle Siebel. Our approach ensures clean data mapping, deduplication and full compliance validation before go-live.

Absolutelym we design HubSpot workflows that connect to your tech stack. Once verification is complete, the lead automatically moves to activation or customer onboarding pipelines with complete visibility.

We’ve connected HubSpot with a wide range of global fintech platforms like Stripe, PayPal, Plaid, and more. Whether it’s payments, compliance, or portfolio data, we bring everything into one system of record.

Yes. With HubSpot’s custom objects and OneMetric’s configuration expertise, we model loans, policies, accounts, and investors inside HubSpot, allowing data to flow cleanly across marketing, sales, and service hubs.

We follow strict security protocols: encrypted transfers, sandbox testing, access restrictions and backup validation. Every migration and integration we run is compliant with both financial data standards and HubSpot’s governance framework.

We build dashboards tailored for fintech and financial services teams - approvals, renewals, MRR, churn, portfolio performance and revenue attribution. Each dashboard is designed for visibility across both compliance and growth teams.

We don't just implement HubSpot - we design systems. As an Elite Partner, we’ve built over 50+ fintech and BFSI setups that combine data architecture, automation, and RevOps alignment. Our focus is simple: make HubSpot work for how financial teams actually operate.

Begin with a short discovery call where we understand your current CRM setup, workflows and objectives. From there, our team outlines what a HubSpot migration or implementation could look like for your financial operations.

Seamless Integrations that help you scale

Core Banking Systems

- FIS

- Jack Henry

- Temenos

Loan Origination & Underwriting Platforms

- Blend

- Encompass

- LoanPro

Payment Processing & Fraud Detection

- Stripe

- Plaid

- Alloy

Wealth & Portfolio Management

- Addepar

- Orion

- Black Diamond

KYC, AML & Compliance Tools

- ComplyAdvantage

- SEON

- Trulioo

Relatable? We should definitely talk.

All that we’ll cover when we speak:

- Opportunities to increase the ROI of your HubSpot investment

- Your current GTM motions and future roadmap

- Challenges that you face with your overall revenue stack

- Missed revenue opportunities due to gaps in your funnel

- What would "wins" look like for you?

Check out Case Studies, Playbooks & more!

Explore how OneMetric is helping GTM teams globally optimize their RevOps ecosystem and scale their sales & marketing efforts.

-

One metricHubspotHow we enhanced sales processes through technology and strategy, yielding significant improvements in efficiency and outcomes

One metricHubspotHow we enhanced sales processes through technology and strategy, yielding significant improvements in efficiency and outcomes -

Salesforce pardotHubspotHow we enhanced sales processes through technology and strategy

Salesforce pardotHubspotHow we enhanced sales processes through technology and strategy -

Google adsHow we helped a furniture rental company decrease their CAC by 67% and increase contribution of Google Ads to revenue by 6X

Google adsHow we helped a furniture rental company decrease their CAC by 67% and increase contribution of Google Ads to revenue by 6X -

WoocommerceKlaviyoHow we helped one of the largest D2C lifestyle brands in the US generate 66% of their entire year’s email campaign revenue in just one quarter.

WoocommerceKlaviyoHow we helped one of the largest D2C lifestyle brands in the US generate 66% of their entire year’s email campaign revenue in just one quarter. -

Google adsSeoSemrushHubspotHow we helped a Digital Marketing firm drive a 71% increase in monthly website sessions by migrating to HubSpot

Google adsSeoSemrushHubspotHow we helped a Digital Marketing firm drive a 71% increase in monthly website sessions by migrating to HubSpot -

HubspotHow our Marketing Automation efforts for a Global Market Intelligence company led to a 28% increase in Meetings Booked

HubspotHow our Marketing Automation efforts for a Global Market Intelligence company led to a 28% increase in Meetings Booked -

HubspotHow CRM Integration increased conversions by 19.5% for this Office Space Rentals Company

HubspotHow CRM Integration increased conversions by 19.5% for this Office Space Rentals Company -

Chillie piperHubspotHow strategic lead management boosted Monthly Pipeline by 83% and achieved a 62% Lead-to-Deal Conversion

Chillie piperHubspotHow strategic lead management boosted Monthly Pipeline by 83% and achieved a 62% Lead-to-Deal Conversion -

KlaviyoHow we helped a jewelry brand drive over $13,000 in sales in a month with Klaviyo

KlaviyoHow we helped a jewelry brand drive over $13,000 in sales in a month with Klaviyo -

FacebookWhatsappOrganic social mediaHow we leveraged strategic demand generation channels to deliver 22% compounded monthly growth in qualified leads for an investment fund

FacebookWhatsappOrganic social mediaHow we leveraged strategic demand generation channels to deliver 22% compounded monthly growth in qualified leads for an investment fund -

Hubspot service hubInsure-techHow we helped a leading insure-tech company reduce time to first response for support tickets by 39%

Hubspot service hubInsure-techHow we helped a leading insure-tech company reduce time to first response for support tickets by 39% -

HubspotApi integrationFintechHow we helped a leading FinTech company increase SMS response rate by 72% by streamlining messaging within HubSpot

HubspotApi integrationFintechHow we helped a leading FinTech company increase SMS response rate by 72% by streamlining messaging within HubSpot -

SalesforceHow we enabled streamlined partner onboarding and collaboration to drive 28%+ sales growth for our client.

SalesforceHow we enabled streamlined partner onboarding and collaboration to drive 28%+ sales growth for our client. -

MigrationHubspotMarketing hubSales hubService hubHow an AI platform achieved unified sales, marketing, and customer onboarding operations by migrating to an integrated HubSpot ecosystem

MigrationHubspotMarketing hubSales hubService hubHow an AI platform achieved unified sales, marketing, and customer onboarding operations by migrating to an integrated HubSpot ecosystem -

Hubspot marketing hubSalesforce integrationA strategic integration of HubSpot and Salesforce to streamline operations, enhance lead nurturing, and boost sales productivity

Hubspot marketing hubSalesforce integrationA strategic integration of HubSpot and Salesforce to streamline operations, enhance lead nurturing, and boost sales productivity -

KlaviyoHow we helped a leading D2C home furniture brand generate almost $150,000 in sales in under 10 weeks

KlaviyoHow we helped a leading D2C home furniture brand generate almost $150,000 in sales in under 10 weeks

.png?width=5528&height=1940&name=OneMetric%20(3).png)

.png?width=1281&height=623&name=Group%201000006017%20(1).png)